44 bond coupon interest rate

› why-do-bond-prices-goWhy Do Bond Prices Go Down When Interest Rates Rise? Feb 16, 2022 · The bond has a 3% coupon (or interest payment) rate, which means that it pays you $30 per year. If you’re paid every six months, you’ll receive $15 in coupon payments. Suppose you want to sell your bond one year later, but the market interest rate has increased to 4%. › 2022/01/19 › heres-how-risingHere’s how rising interest rates may affect your bond ... Jan 19, 2022 · Here’s how the Fed’s expected interest rate hikes may affect bond portfolios. ... let's say you have a 10-year $1,000 bond paying a 3% coupon. If market interest rates rise to 4% in one year ...

Solved Unlike the coupon interest rate, which is fixed, a | Chegg.com A bond is more likely to be called if its price is ____ because this means that the going market interest rate is less than its coupon rate. Quantitative Problem: Ace Products has a bond issue outstanding with 15 years remaining to maturity, a coupon rate of 8.4% with semiannual payments of $42, and a par value of $1,000. The price of each bond ...

Bond coupon interest rate

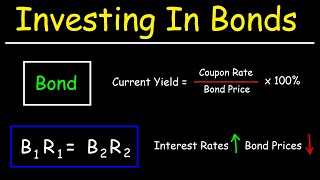

Coupon Rate - Definition - The Economic Times Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value. For example, if you have a 10-year- Rs 2,000 bond with a coupon rate of 10 ... Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate Formula. Coupon Rate is the interest rate that is paid on a bond/fixed income security. It is stated as a percentage of the face value of the bond when the bond is issued and continues to be the same until it reaches maturity. Once fixed at the issue date, coupon rate of bond remain unchanged till the tenure of the bond and the ... If Interest Rates Rise, What Happens to Bond Prices? How Interest Rates Affect Bonds. Although interest rates usually rise in response to rising inflation, this can have an unintended consequence on bonds. To understand this, we must establish that bond yields are based on a bond's annual interest rate, also known as the coupon or coupon payment, and price. The bond's coupon payment is the ...

Bond coupon interest rate. What Is the Coupon Rate of a Bond? - The Balance A coupon rate is the annual amount of interest paid by the bond stated in dollars, divided by the par or face value. For example, a bond that pays $30 in annual interest with a par value of $1,000 would have a coupon rate of 3%. Understanding Pricing and Interest Rates — TreasuryDirect The price and interest rate of a bond are determined at auction. The price may be greater than, less than, or equal to the bond's par amount (or face value). (See rates in recent auctions .) The price of a fixed rate security depends on its yield to maturity and the interest rate. Coupon Rate Calculator | Bond Coupon 15/07/2022 · With this coupon rate calculator, we aim to help you to calculate the coupon rate of your bond investment based on the coupon payment of the bond.Coupons are one of your two main sources of income when investing in bonds. Thus, it is essential to understand this concept before you dabble in the bond investment world.. We have prepared this article to help you … What is a Coupon Rate? - Definition | Meaning | Example Definition: Coupon rate is the stated interest rate on a fixed income security like a bond. In other words, it's the rate of interest that bondholders ...

I bonds interest rates — TreasuryDirect Current Interest Rate. Series I Savings Bonds. 9.62%. For savings bonds issued May 1, 2022 to October 31, 2022. Complete the purchase of this bond in TreasuryDirect by October 28, 2022 to ensure issuance by October 31, 2022. Fixed rate. You know the fixed rate of interest that you will get for your bond when you buy the bond. Investor BulletIn Interest rate risk — When Interest rates Go up ... For example, imagine one bond that has a coupon rate of 2% while another bond has a coupon rate of 4%. All other features of the two bonds—when they mature, their level of credit risk, and so on—are the same. If market interest rates rise, then the price of the bond with the 2% coupon rate will fall more than that of the bond with the 4% investor.vanguard.com › what-is-a-bondWhat’s a bond? | Vanguard Coupon: This is the interest rate paid by the bond. In most cases, it won't change after the bond is issued. Yield: This is a measure of interest that takes into account the bond's fluctuating changes in value. There are different ways to measure yield, but the simplest is the coupon of the bond divided by the current price. Coupon Rate Calculator | Bond Coupon coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%. Even though you now know how to find the coupon rate of a bond, you can always use this coupon rate calculator to estimate the result in no time! What is the difference between bond coupon rate and yield to maturity (YTM)?

Bond Basics: How Interest Rates Affect Bond Yields When interest rates rise, prices of existing bonds tend to fall, even though the coupon rates remain constant: Yields go up. Conversely, when interest rates fall, prices of existing bonds tend to rise, their coupon remains constant - and yields go down. Quality matters. Not surprisingly, a bond's quality also has direct bearing on its price ... Bond Price Calculator Let's assume that someone holds for a period of 10 years a bond with a face value of $100,000, with a coupon rate of 7% compounded semi-annually, while similar bonds on the market offer a rate of return of 6.5%. Let's figure out its correct price in case the holder would like to sell it: Bond price = $103,634.84 Coupon Rate Definition - Investopedia A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. For example, a bond issued with a face value of $1,000... Understanding Coupon Rate and Yield to Maturity of Bonds Here's a sample computation for a Retail Treasury Bond issued by the Bureau of Treasury: Security Name. Coupon Rate. Maturity Date. RTB 03-11. 2.375%. 3/9/2024. The Coupon Rate is the interest rate that the bond pays annually, gross of applicable taxes. The frequency of payment depends on the type of fixed income security.

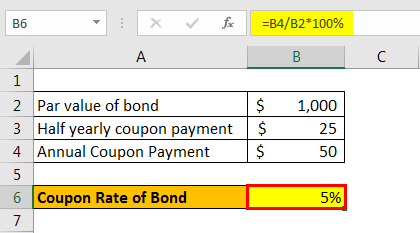

What Is Coupon Rate and How Do You Calculate It? - SmartAsset.com To calculate the bond coupon rate we add the total annual payments and then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate.

› terms › zZero-Coupon Bond Definition - Investopedia May 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

Bond Prices, Rates, and Yields - Fidelity While you own the bond, the prevailing interest rate rises to 7% and then falls to 3%. 1. The prevailing interest rate is the same as the bond's coupon rate. The price of the bond is 100, meaning that buyers are willing to pay you the full $20,000 for your bond. 2. Prevailing interest rates rise to 7%.

Basics Of Bonds - Maturity, Coupons And Yield - InCharge Debt Solutions Bond Coupon Payments. A bond's coupon is the annual interest rate paid on the issuer's borrowed money, generally paid out semi-annually on individual bonds. The coupon is always tied to a bond's face or par value and is quoted as a percentage of par. Say you invest $5,000 in a six-year bond paying a coupon rate of five percent per year ...

› ask › answersRelationship Between Interest Rates & Bond Prices - Investopedia May 16, 2022 · Conversely, if interest rates rise, investors will no longer prefer the lower fixed interest rate paid by a bond, resulting in a decline in its price. ... If rates dropped to 3%, our zero-coupon ...

Types of Coupon Rates in Fixed Income Securities Floating Rate: Floating rate coupon payments bonds are different from regular bonds in the sense that the interest rate is expressed in terms of a benchmark ...

Bonds and Interest Rates | FINRA.org Say you bought a $1,000 bond with a 6 percent coupon a few years ago and decided to sell it three years later to pay for a trip to visit your ailing grandfather, except now, interest rates are at 4 percent. This bond is now quite attractive compared to other bonds out there, and you would be able to sell it at a premium. Basis Point Basics

Coupon Rate of a Bond - WallStreetMojo Coupon Rate is referred to the stated rate of interest on fixed income securities such as bonds. In other words, it is the rate of interest that the bond issuers pay to the bondholders for their investment. It is the periodic rate of interest paid on the bond's face value to its purchasers.

corporatefinanceinstitute.com › coupon-rateCoupon Rate - Learn How Coupon Rate Affects Bond Pricing Mar 04, 2022 · The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions.

How Is the Interest Rate on a Treasury Bond Determined? 29/08/2022 · Interest Rate Vs. Coupon Rate Vs. Current Yield . T-bonds don't carry an interest rate as a certificate of deposit (CDs) would. Instead, a set percent of the face value of the bond is paid out at ...

Coupon Bond - Guide, Examples, How Coupon Bonds Work Let's imagine that Apple Inc. issued a new four-year bond with a face value of $100 and an annual coupon rate of 5% of the bond's face value. In this case, Apple will pay $5 in annual interest to investors for every bond purchased. After four years, on the bond's maturity date, Apple will make its last coupon payment.

Treasury Coupon Issues | U.S. Department of the Treasury Nominal TNC Data TNC Treasury Yield Curve Spot Rates, Monthly Average: 1976-1977TNC Treasury Yield Curve Spot Rates, Monthly Average: 1978-1982TNC Treasury Yield Curve Spot Rates, Monthly Average: 1983-1987TNC Treasury Yield Curve Spot Rates, Monthly Average: 1988-1992TNC Treasury Yield Curve Spot Rates, Monthly Average: 1993-1997TNC Treasury Yield Curve Spot Rates, Monthly Average: 1998 ...

Coupon Rate: Formula and Calculation - Wall Street Prep The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6% Annual Coupon = $100,000 x 6% = $6,000

Difference Between Coupon Rate and Interest Rate The coupon rate is normally used in the bonds, which is an income to the holder after paying the rate on certain purchased items. Interest rate is a reduction to the borrower by paying back the amount he/she has borrowed. The coupon Rate ends according to the maturity period mentioned by the bondholder while issuing the bond.

Coupon Rate vs Interest Rate - WallStreetMojo a coupon rate refers to the rate which is calculated on face value of the bond i.e., it is yield on the fixed income security that is largely impacted by the government set interest rates and it is usually decided by the issuer of the bonds whereas interest rate refers to the rate which is charged to borrower by lender, decided by the lender and …

Coupon rate definition — AccountingTools A coupon rate is the interest percentage stated on the face of a bond or similar instrument. This is the interest rate that a bond issuer pays to a bond holder, usually at intervals of every six months. The current yield may vary from the coupon rate, depending on the price at which an investor buys a bond.

› ask › answersBond Coupon Interest Rate: How It Affects Price - Investopedia A bond's coupon rate denotes the amount of annual interest paid by the bond's issuer to the bondholder. Set when a bond is issued, coupon interest rates are determined as a percentage of the bond's...

Coupon Interest and Yield for eTBs | australiangovernmentbonds What is the Coupon Interest Rate? The Coupon Interest Rate on a Treasury Bond is set when the bond is first issued by the Australian Government, and remains fixed for the life of the bond. For example, a Treasury Bond with a 5% Coupon Interest Rate will pay investors $5 a year per $100 Face Value amount in instalments of $2.50 every six months.

Understanding the Relationship Between Coupon Rates and Duration 1 - Lower coupon bonds are more sensitive to interest rates than high coupon bonds. 2 - There is inverse relationship between bond prices and change in interest rates. ... Accordingly, a high coupon rate bond has a lower duration that a low coupon bond. For example, if I purchase a zero-coupon bond on its issue date the bond will have a ...

Coupon Payment Calculator Assuming you purchase a 30-year bond at a face value of $1,000 with a fixed coupon rate of 10%, the bond issuer will pay you: $1,000 * 10% = $100 as a coupon payment. If the bond agreement is semiannual, you'll receive two payments of $50 on the bond agreed payment dates.

What Is a Bond Coupon? - The Balance A bond's coupon refers to the amount of interest due and when it will be paid. A $100,000 bond with a 5% coupon pays 5% interest. The broker takes your payment and deposits the bond into your account when you invest in a newly issued bond through a brokerage account. There it sits alongside your stocks, mutual funds, and other securities.

If Interest Rates Rise, What Happens to Bond Prices? How Interest Rates Affect Bonds. Although interest rates usually rise in response to rising inflation, this can have an unintended consequence on bonds. To understand this, we must establish that bond yields are based on a bond's annual interest rate, also known as the coupon or coupon payment, and price. The bond's coupon payment is the ...

Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate Formula. Coupon Rate is the interest rate that is paid on a bond/fixed income security. It is stated as a percentage of the face value of the bond when the bond is issued and continues to be the same until it reaches maturity. Once fixed at the issue date, coupon rate of bond remain unchanged till the tenure of the bond and the ...

Coupon Rate - Definition - The Economic Times Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value. For example, if you have a 10-year- Rs 2,000 bond with a coupon rate of 10 ...

.png)

:max_bytes(150000):strip_icc()/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

Post a Comment for "44 bond coupon interest rate"