44 zero coupon bonds duration

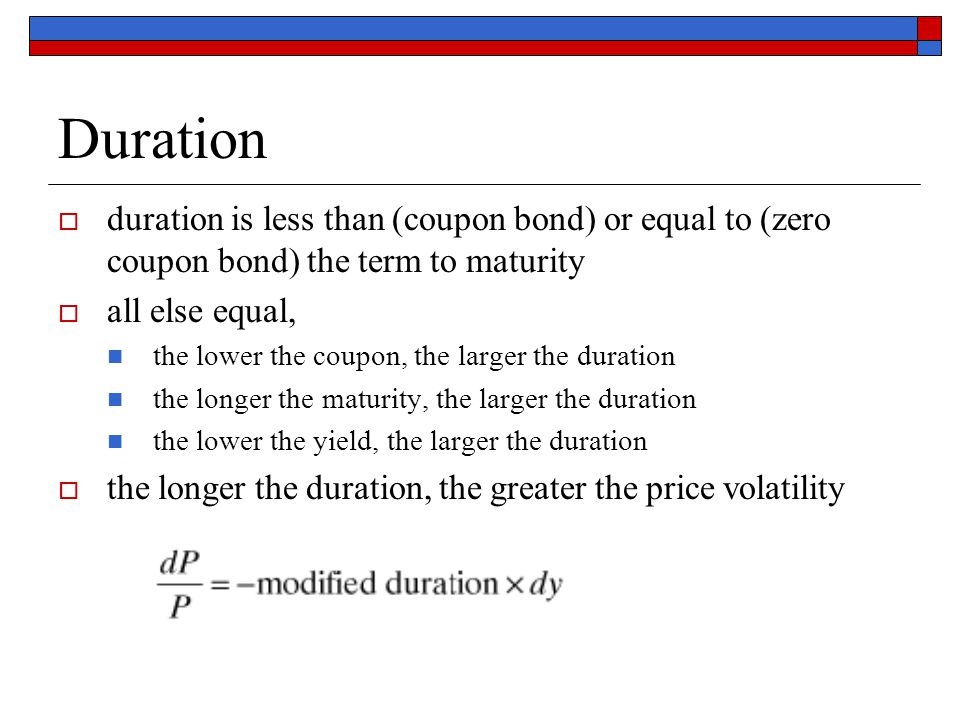

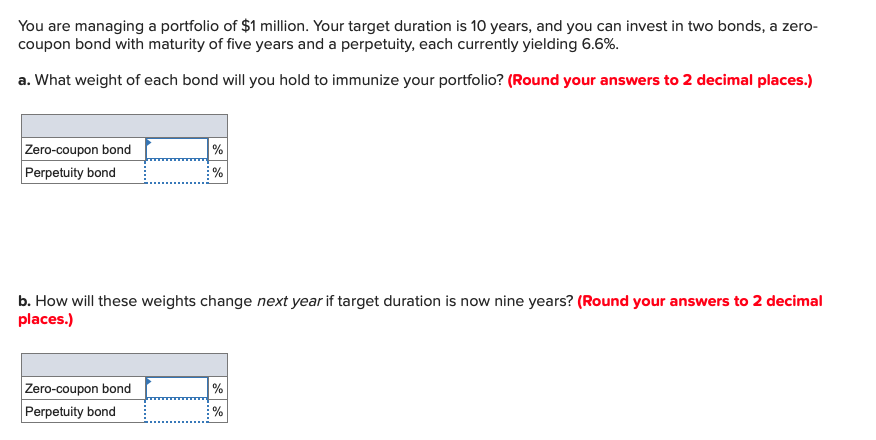

Zero Coupon Bond Calculator – What is the Market Price? - DQYDJ Since zero coupon bonds have an equal duration and maturity, interest rate changes have more effect on zero coupon bonds than regular bonds maturity at the same time. (Whether that's good or bad is up to you!) Zero coupon bonds are particularly sensitive to interest rates, so they are also sensitive to inflation risks. Inflation both erodes the ... Duration and Zero Coupon Bonds - YouTube Oct 2, 2020 ... Examples of Macaulay duration are given for zero coupon bonds.

Treasuries - WSJ News Corp is a global, diversified media and information services company focused on creating and distributing authoritative and engaging content and other products and services.

Zero coupon bonds duration

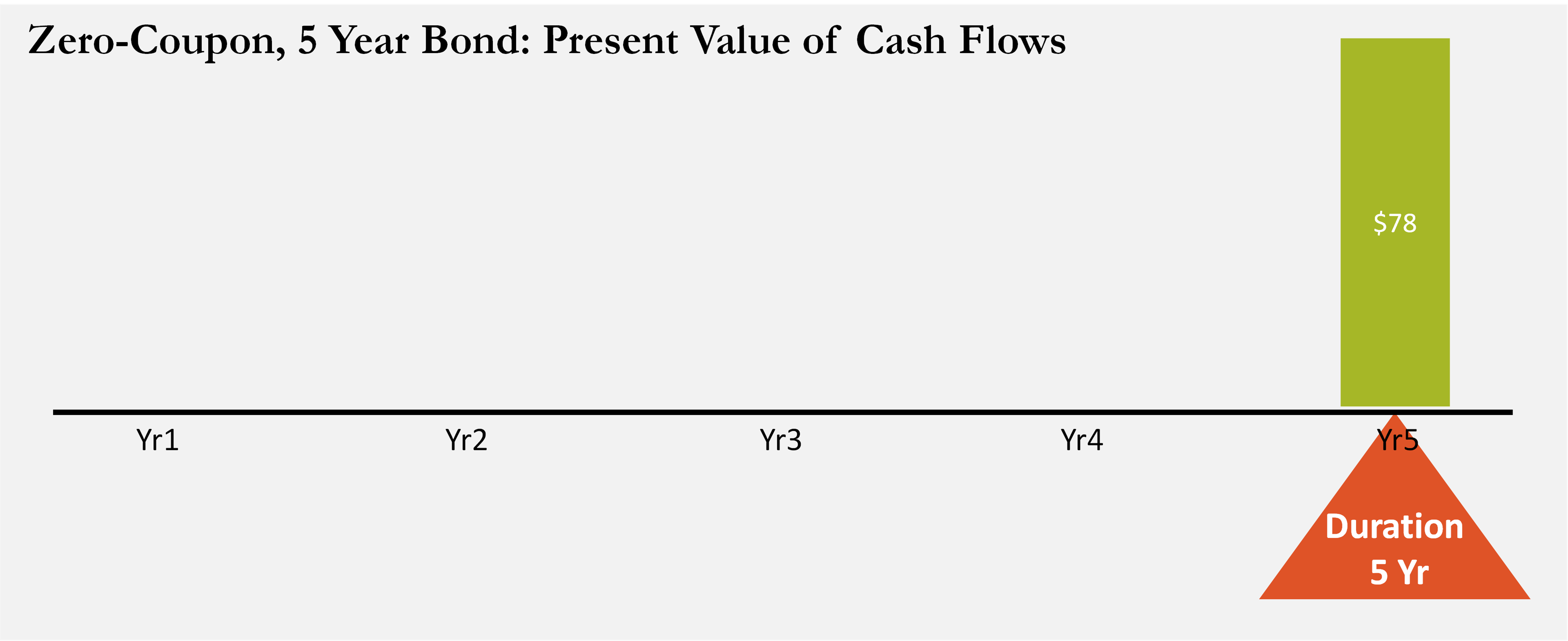

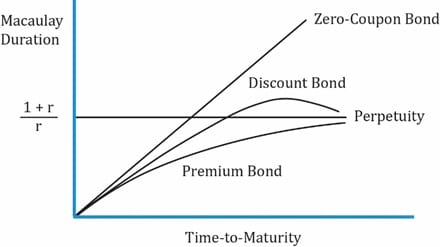

The One-Minute Guide to Zero Coupon Bonds | FINRA.org Oct 20, 2022 · Like virtually all bonds, zero coupon bonds are subject to interest-rate risk if you sell before maturity. If interest rates rise, the value of your zero coupon bond on the secondary market will likely fall. Long-term zeros can be particularly sensitive to changes in interest rates, exposing them to what is known as duration risk. Also, zeros ... The One-Minute Guide to Zero Coupon Bonds | FINRA.org 20/10/2022 · Like virtually all bonds, zero coupon bonds are subject to interest-rate risk if you sell before maturity. If interest rates rise, the value of your zero coupon bond on the secondary market will likely fall. Long-term zeros can be particularly sensitive to changes in interest rates, exposing them to what is known as duration risk. Also, zeros ... Zero-coupon bond - Wikipedia Zero coupon bonds have a duration equal to the bond's time to maturity, which makes them sensitive to any changes in the interest rates. Investment banks or dealers may separate coupons from the principal of coupon bonds, which is known as the residue, so that different investors may receive the principal and each of the coupon payments.

Zero coupon bonds duration. Zero Coupon Bond Calculator – What is the Market Price? - DQYDJ Since zero coupon bonds have an equal duration and maturity, interest rate changes have more effect on zero coupon bonds than regular bonds maturity at the same time. (Whether that's good or bad is up to you!) Zero coupon bonds are particularly sensitive to interest rates, so they are also sensitive to inflation risks. Inflation both erodes the ... Zero-coupon bond - Wikipedia Zero coupon bonds have a duration equal to the bond's time to maturity, which makes them sensitive to any changes in the interest rates. Investment banks or dealers may separate coupons from the principal of coupon bonds, which is known as the residue, so that different investors may receive the principal and each of the coupon payments. That creates a supply of new … Treasuries - WSJ Market Data Center on The Wall Street Journal. 4 Measuring Interest-Rate Risk: Duration - FIU Faculty Websites A long-term discount bond with ten years to maturity, a so-called zero-coupon bond, makes all of its payments at the end of the ten years, whereas a 10% coupon ...

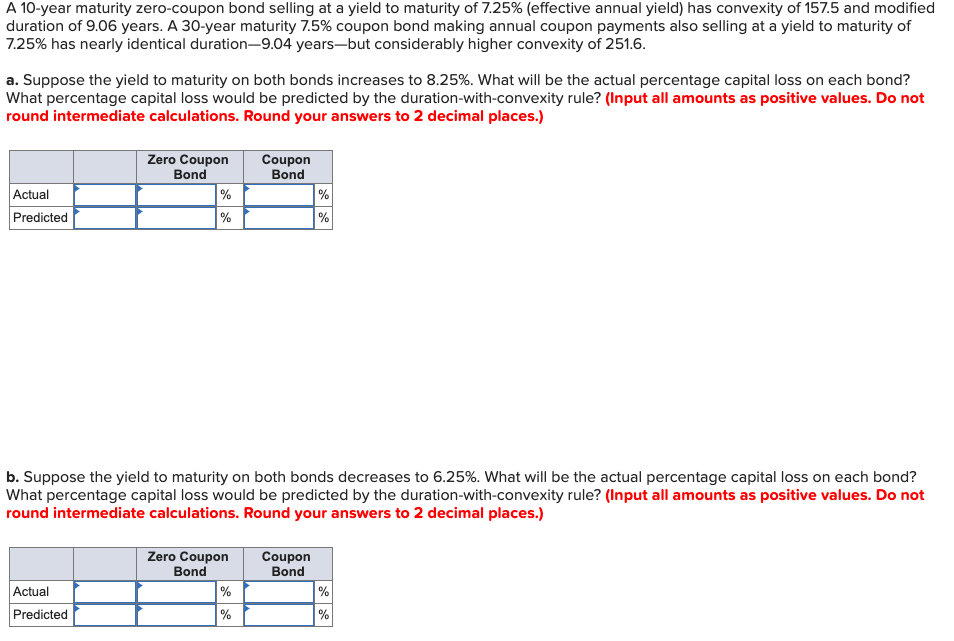

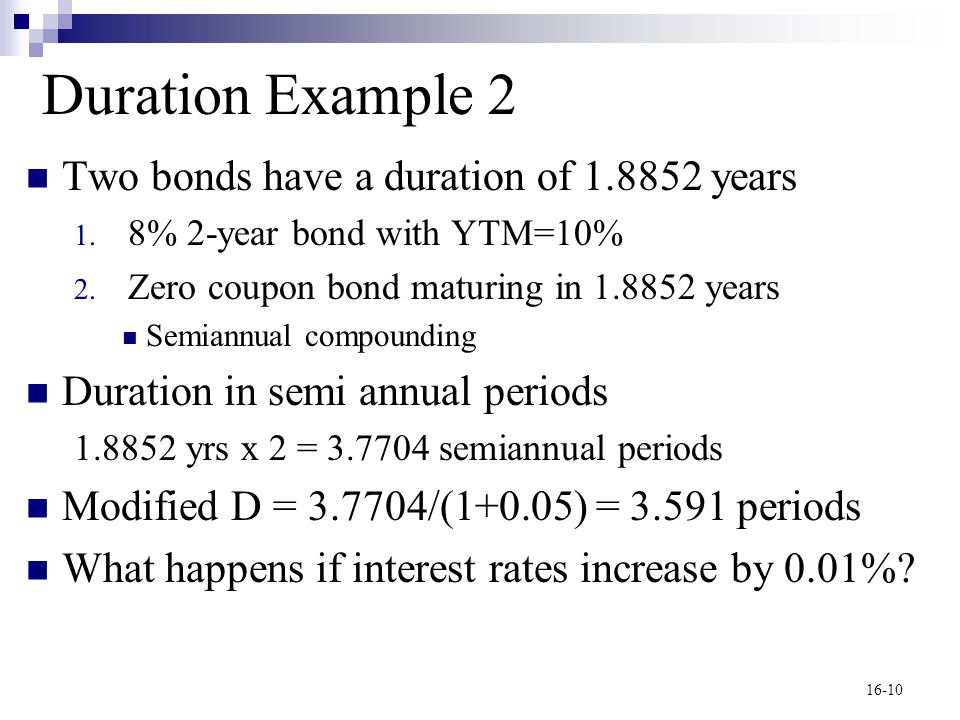

Duration Definition and Its Use in Fixed Income Investing - Investopedia 01/09/2022 · Duration is a measure of the sensitivity of the price -- the value of principal -- of a fixed-income investment to a change in interest rates. Duration is expressed as a number of years. Bond ... Modified duration of zero-coupond bond (FRM practice question) Jun 28, 2010 ... A zero-coupon bond with maturity of ten (10) years has a 6% bond-equivalent yield (semi-annual compounding). What is the bond's modified ... Understanding Duration | BlackRock For example, a 5-year zero coupon bond may be more sensitive to interest rate changes than a 7-year bond with a 6% coupon. By comparing the bonds' durations, ... What is the duration of a zero coupon bond? - Quora Zero coupon bond can be of any duration , can be from one year to 10 years. It is ordinarily from 3 to 5 years. Zero coupon bonds are issued at a discount with ...

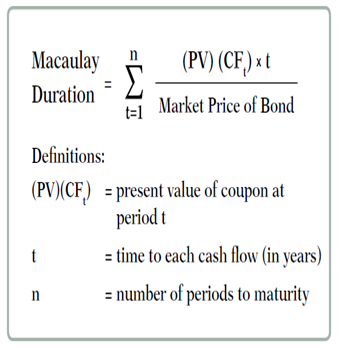

Bonds & Rates - WSJ Stocks: Real-time U.S. stock quotes reflect trades reported through Nasdaq only; comprehensive quotes and volume reflect trading in all markets and are delayed at least 15 minutes. The Macaulay Duration of a Zero-Coupon Bond in Excel 29/08/2022 · Find out more about the Macaulay duration and zero-coupon bonds, and how to calculate the Macaulay duration of a zero-coupon bond in Microsoft Excel. Advantages and Risks of Zero Coupon Treasury Bonds 31/01/2022 · Zero-coupon bonds are also appealing for investors who wish to pass wealth on to their heirs but are concerned about income taxes or gift taxes. If a zero-coupon bond is purchased for $1,000 and ... Zero-Coupon Bonds: Characteristics and Calculation Example If the zero-coupon bond compounds semi-annually, the number of years until maturity must be multiplied by two to arrive at the total number of compounding ...

The Macaulay Duration of a Zero-Coupon Bond in Excel Aug 29, 2022 · The Macaulay duration of a zero-coupon bond is equal to the time to maturity of the bond. Simply put, it is a type of fixed-income security that does not pay interest on the principal amount.

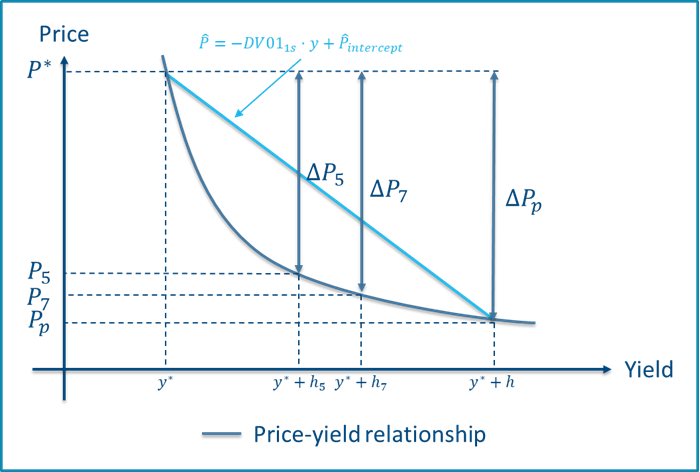

Duration - NYU Stern For zero-coupon bonds, there is a simple formula relating the zero price to the zero rate. •We use this price-rate formula to get a formula for dollar duration.

Zero-Coupon Bond: Definition, How It Works, and How To Calculate A zero-coupon bond is a debt security that doesn't pay interest but trades at a deep discount, rendering profit at maturity when it is redeemed.

Bonds & Rates - WSJ Bonds & Rates News. A Lack of Bond Buyers Pushes Mortgage Rates Higher. Easing Inflation Ignites Bond-Market Rally. Fed’s Hard Line on Interest Rates Fuels Bond Rout. View More.

Zero Coupon Bond Modified Duration Formula | Bionic Turtle Zero-coupon bonds are popular (in exams) due to their computational convenience. We barely need a calculator to find the modified duration of this 3-year, zero- ...

Zero Coupon Bond Value Calculator: Calculate Price, Yield to … If rates fall longer duration zero-coupon bonds will increase in value significantly more than shorter duration federal government bonds & federal bonds which pay a regular coupon. If rates rise the converse is true - zero-coupon bonds will be hit much harder than other bonds. Negative Yields . After the financial crisis of 2008-2009 central banks became far more …

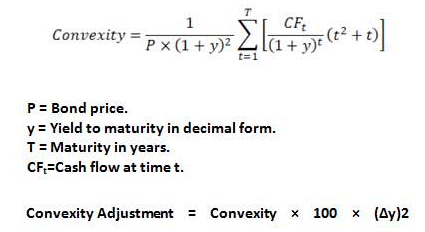

The Basics of Bonds - Investopedia 31/07/2022 · Duration can be calculated on a single bond or for an entire portfolio of bonds. Bonds and Taxes Because bonds pay a steady interest stream, called the coupon, owners of bonds have to pay regular ...

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Jan 31, 2022 · Zero-coupon bonds are also appealing for investors who wish to pass wealth on to their heirs but are concerned about income taxes or gift taxes. If a zero-coupon bond is purchased for $1,000 and ...

Zero-coupon bond - Wikipedia Zero coupon bonds have a duration equal to the bond's time to maturity, which makes them sensitive to any changes in the interest rates. Investment banks or dealers may separate coupons from the principal of coupon bonds, which is known as the residue, so that different investors may receive the principal and each of the coupon payments.

The One-Minute Guide to Zero Coupon Bonds | FINRA.org 20/10/2022 · Like virtually all bonds, zero coupon bonds are subject to interest-rate risk if you sell before maturity. If interest rates rise, the value of your zero coupon bond on the secondary market will likely fall. Long-term zeros can be particularly sensitive to changes in interest rates, exposing them to what is known as duration risk. Also, zeros ...

The One-Minute Guide to Zero Coupon Bonds | FINRA.org Oct 20, 2022 · Like virtually all bonds, zero coupon bonds are subject to interest-rate risk if you sell before maturity. If interest rates rise, the value of your zero coupon bond on the secondary market will likely fall. Long-term zeros can be particularly sensitive to changes in interest rates, exposing them to what is known as duration risk. Also, zeros ...

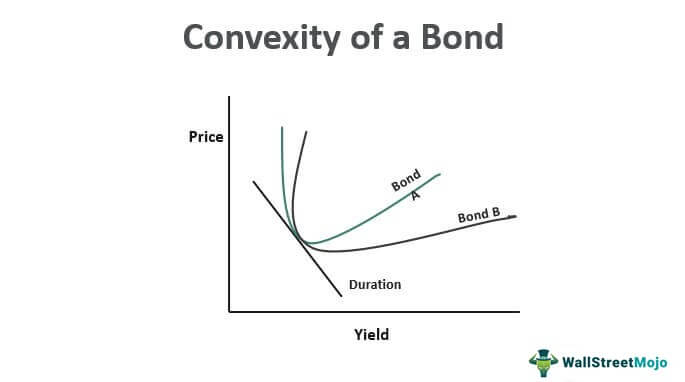

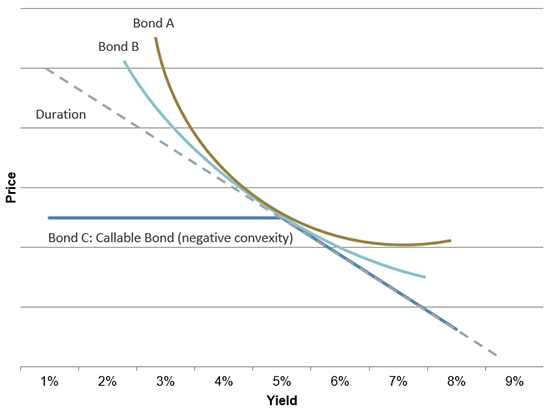

:max_bytes(150000):strip_icc()/DurationandConvexitytoMeasureBondRisk2-0429456c85984ad3b220cd23a760cda5.png)

![PDF] Duration and convexity of zero-coupon convertible bonds ...](https://d3i71xaburhd42.cloudfront.net/39b5487ce4f8becdfb0faf5ae6e30fd10537436c/13-Figure5-1.png)

Post a Comment for "44 zero coupon bonds duration"